Launch Best-in-Class Credit Programs to Grow Revenue

Competing for today’s cardholders requires card programs that offer an excellent customer experience and innovative functionalities that help consumers and businesses to achieve their financial goals.

Let i2c’s modern platform help you build a tailored card programs that has everything to meet your customers’ everchanging needs.

Today’s credit card issuers — banks, credit unions, fintechs, and neobanks—are tasked with offering customers a robust set of credit products that enables them to go to market quickly. And there’s more to credit product solutions than just meeting customer demand. Card issuers need to differentiate their products from competitors and break the cookie cutter credit card mold while offering a valuable product that stays top of wallet.

Credit cards and other credit-based products, such as buy now pay later (BNPL), are some of the most popular financial products in the U.S., growing in popularity year over year. Demand for credit is expected to fuel the growth of the credit card market as well as fintech innovation for products like buy now pay later, consumer credit and commercial credit solutions, and prepaid credit cards.

This resource page was designed for issuers to use as a comprehensive, reliable reference.

-

Learn more about credit products.

-

Break free from cookie-cutter credit cards.

-

Use industry data to drive brand preference.

-

Customize credit solution set(s).

Best in Class Credit Solutions

i2c named “Best in Class” provider in the Credit-Card-as-a-Service (CCaaS) category by Aite-Novarica Group, a global advisory firm providing mission-critical insights in the financial services industry.

Download Report

Latest Articles

- Credit / BNPL Buy Now Pay Later: A Helping Hand Without Unpleasant Surprises

- Client News i2c Partners With Car IQ To Deliver a Superior Cost Management Tool for Fleet Operators

- Credit / BNPL Today’s Payments Ecosystem – the Opportunities and Challenges

- Digital Banking Embedded Banking: Driving Profits Outside of Deposits and Lending

Consumer Credit

While the market for consumer credit cards continues to grow, it’s dominated by a handful of major banks and payment networks. According to a July 2021 report by the U.S. Federal Reserve, consumer credit increased at a seasonally adjusted annual rate of 10 percent through May 2021.

How can community and regional banks compete with the credit card giants? Technology is a key part of how consumers conduct their banking, and big banks have invested lots of time and money into adopting and pioneering new financial technologies that improve customer service.

Community banks, regional banks, and credit unions can tap into new technologies while coupling this strategy with their highly personal customer service.

Read More-

Beyond the card – innovating next-gen credit solutions

Four key trends are driving innovation in consumer credit today – card ubiquity, cloud-based payments processing, mobile integrations, and digital-first card programs – as well as new options in credit, risk, and portfolio management. The foundation laid by card networks has given rise to the digital payments ecosystem, enabling a much wider and more diverse set of players to leverage those rails and expand access to a variety of credit products delivered via digital channels.

-

How digitally savvy consumers are reshaping credit expectations globally

Banking’s mission continues to center around putting the customer first and providing efficient financial services products for them as they evolve. Yet, consumer behavior and expectations have shifted dramatically in the last decade and a new type of consumer is emerging: one that is educated, connected and wanting instant everything. Being digitally empowered, customers today expect their credit card providers to deliver services that are on par with the experiences they are offered by other organizations like Amazon or any online business.

-

How can banks boost their credit card issuing program?

Calling all small- to mid-size credit card issuers! Let’s talk about card issuing. More specifically, let’s talk about how you, the community and regional financial institution (FI), can totally increase your bank’s value by bringing your current credit card issuing program in house or by offering your customers a card program for the very first time.

-

What KPIs should you track for prepaid and credit card programs?

We all know that tracking key performance indicators (KPIs) is a best practice across a broad range of disciplines. It is also a best practice for your prepaid, debit and credit card programs.

- Load More

Commercial Credit

Smaller competitors with smaller cash reserves and a lower risk tolerance are struggling to compete with industry giants when it comes to Commercial credit. According to a Forbes article, it isn’t just massive reserves that separate new entrants (like Amazon, Facebook, and Walmart) from smaller banks and credit unions.

“A digital-first mentality contributes to efficiency and customer satisfaction in a way that in-person and paper transactions simply cannot.” The Federal Reserve’s 2019 Small Business Credit Survey reported “small business owners value speed over interest rate,” which is precisely where fintechs thrive.

Smaller players in the B2B space who partner with the right issuer processor can become trailblazers in a reversal of roles.

Read More-

The future of payments with Jim McCarthy

Jim McCarthy, President of i2c, recently sat down with Unifimoney to discuss the future of the digital payments industry. Jim spent 20 years at Visa where he entered the payments space right before the Dot Com boom began to shift the world to online. After holding the title of Executive Vice President of Innovation & Strategic Partnerships at Visa, Jim joined i2c, an issuer processing business that he believes will completely disrupt the digital payments space around the world. You guys are experts at backend payments technology. Is there a lesser-known bit of payment technology that’s been a game-changer over these last five years?

-

Why the pandemic is a ‘Black Swan’ that will spur payments

In an interview with Karen Webster, Jim McCarthy, President at i2c, said that the digital shift will continue to spur tie-ups of all sorts – from partnerships to outright buyouts – as incumbents seek to move quickly to modernize their tech stacks. This interview was the first in a series of multiple conversations about the ‘race’ that is bringing stakeholders in the payments processing, credit and financial service industries together through a continuing spate of mergers, acquisitions and partnerships.

-

B2B payments after COVID-19: Could rising electronic payments and API usage finally kill the paper check?

All businesses have sustained some short of shock by the COVID-19 pandemic…there are just those that have already switched or are in the process of moving to electronic payments to make their processes more or less digitized. Jim McCarthy, President of i2c Inc. and special guest of a recent PYMNTS Trend Talk series, said that the companies that had already implemented “electronic invoicing, electronic bill payment remittances [not only the front end of their business but the back end as well] – for a global, ecosystem of payments – were in a better position to weather the initial hit and are more likely to feel confident about making it through.”

-

Innovating B2B payments report

Businesses are attempting to keep up with a world where staying competitive requires embracing digital-first approaches to not just conducting day-to-day business but also sending and receiving payments. Digital payments have essentially gone from being a “nice-to-have” to a “must-have” for businesses globally. Experts estimate that at least 80 percent of the overall business-to-business (B2B) sales cycle is set to become digital and remote in the near future, and firms are also looking to expand into other markets as commerce becomes more global. This ongoing B2B payments digitization trend has intensified over the course of the pandemic.

- Load More

Buy Now Pay Later

Buy now pay later (BNPL) payment options continue to grow in popularity among consumers. According to an article published by Finextra, financial institutions (FI) need to act now. Their blog post asserts that payments have historically been a standard commodity, purely driven by volume, “however, times change and there is growing interest in payments as a major brand touchpoint and an opportunity to add value, for example with point of sale (POS) financing.” And while the lines are blurred when trying to distinguish between POS lending and BNPL, one thing is certain: customers want payment options and FIs are in a position to deliver a branded, feature-rich solution that keeps them top of wallet.

Read More-

Why small businesses are leading the way in fintech innovation

With the recent announcement that Square is acquiring Afterpay, a leading Australian provider of Buy Now Pay Later (BNPL) solutions, I’m struck by just how much the Small/Medium Business (SMB) space has leapt to the forefront of fintech and probably shines a light on the “art of the possible” for open banking initiatives globally.

-

Buy now pay later – no credit check? The better layaway plan

If you're a card issuer—whether an issuing bank, neo bank, credit union, or fintech—buy now pay later (BNPL) has been on your radar. A recent study reported 197% year-over-year growth from 2019 to 2020 in the U.S. market, where BNPL is "still in its infancy." In that same study, more than 75% of the customer panel chose to use BNPL even though they had the funds to cover the full cost of the purchase. Don’t forget to check out this buy now pay later blog post what traditional card issuers should know about BNPL!

-

Buy now pay later: What traditional card issuers should know

Buy now pay later (BNPL), also known as point-of-sale lending or POS financing, seems to be everywhere. New use cases pop up regularly, with fintechs tapping into the growing consumer demand for alternatives to traditional credit financing. Although BNPL has become one of the hottest emerging trends in payments, the concept itself has been around for quite some time. Today, consumer financing goes well beyond simple installment loans with special interest rates. Fintech platforms have taken an existing payment solution and enhanced it in two ways to make it a very appealing option for consumers.

-

From BNPL to wallets, rising payment options create clutter, add friction

For many years, payments have been the conduit for new and improved user experiences in commerce. In just the past year, with development of the COVID pandemic, contactless payment options have been widely adopted by consumers while digital banking and digital wallets have also gained significant traction. We are gradually seeing the rise of the super app, where transactions are aggregated, secured and presented to the consumer in a user-friendly mobile fashion.

-

Banks use data, deep pockets and trust to prep BNPL entry

Ava Kelly, chief product officer at i2c, told PYMNTS that banks, after observing digital upstarts, are now fully ready to embrace buy now, pay later (BNPL) initiatives while playing up their competitive strengths. The potential market for BNPL, she said, tops $5 trillion.

-

Regulatory Showdowns Looming for BNPL, Crypto and Swipe Fees

For two years now, a furiously digitizing financial sector has read regulatory signals across several pressing fronts from buy now, pay later (BNPL) to cryptocurrency, awaiting decisions from Washington that hold the potential to transform the landscape for newcomers and established players alike. Seasoned pros acknowledge that 2022 may present a nearly unprecedented slate of showdowns.

-

Regulatory showdowns looming for BNPL, crypto and swipe fees

Buy now, pay later (BNPL) has become the modern-day version of layaway, but with a better value proposition — the consumer can buy now, take possession of the merchandise now and pay for it in equal monthly installments later. This new way to pay also provides an opportunity to reach new customers, Jim McCarthy, president of i2c, told Karen Webster in a recent conversation.

- Load More

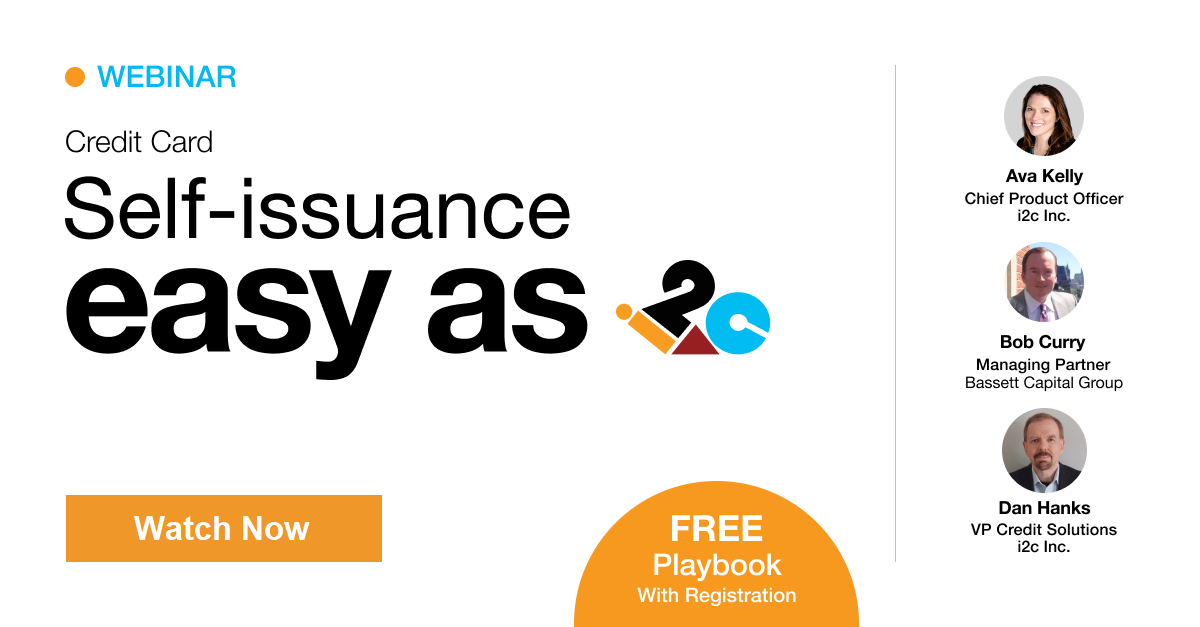

Self-issuance

Financial institutions (FIs) and fintechs are increasingly considering self-issuing credit cards and taking control of their credit programs. Using an agent bank to issue credit cards is challenged by several factors including a legacy infrastructure or “cookie cutter” approach and the inability to own the customer experience and brand.

Creating a unique consumer or commercial card program allows them to gain equal footing with larger financial institutions, offer a differentiated product and increase revenue. By bringing card issuing in-house, FIs and fintechs must consider key drivers such as customer retention, revenue expansion and digital transformation.

The decision to self-issue credit cards takes place against an inflection point of rapid-paced technology innovation and ever-changing consumer expectations. According to a recent Juniper Research study, the number of credit cards issued digitally will nearly triple globally by 2027 to 321 million.1 Therefore, the ability to consistently deliver a credit product digitally will be paramount.

By self-issuing with a next-generation platform, FIs and fintechs can retain profits and gain the benefits of controlling the customer experience and protecting their brands.

1 Juniper Research. Credit Card Strategies: 2023-2027 (2023)

Read More-

Now Is the Time to Bring Card Issuing In House

i2c’s vice president of global product management, Dan Hanks, spoke with David Shipper, strategic advisor at Aite Novarica, and John Chappelle, chief digital officer at Community Bank of the Chesapeake, about why now is the time to self-issue credit cards.

-

Self-issuance easy as i2c

With growing customer expectations, now is the time to introduce a self-issuance credit card program. Self-issuance provides banks and credit unions with the ability to gain equal footing with larger banks and create a differentiated product that helps increase revenue.

Additional Resources

-

E-book: The ultimate guide for credit card issuers

You can offer your customers more than the same old cookie-cutter credit card program while keeping your card top of wallet and generating new revenue streams. In this e-book, we’ve outlined a list of seven key features you should consider to boost your card program.

-

Infographic: 7 must-have features for your card program

The hardest part for issuing banks and credit union is breaking free from the mindset that digital transformation is too expensive or too difficult.

-

Credit program solutions

The credit opportunity is real. Credit cards are one of the most commonly-held and widely-used financial products in the US and growing exponentially year over year. It is projected that purchase volume will more than double globally in the next eight years.

-

Credit processing

Design, Iterate, and Deliver Customized Credit Products That Set You Apart. More and more, consumers are shifting from cash to digital payments, motivated by the convenience, flexibility, and the other perks that come with using credit cards. It’s a big opportunity, but success means getting to market fast with differentiated products that have the compelling features today’s consumers value.

- Load More